Featured

Table of Contents

Home loan insurance policy pays off your home loan to the bank, while life insurance coverage offers a fatality advantage to your chosen beneficiary for different costs. What makes a house a home? Some would certainly claim that a house is not a home up until it is filled up with family and various other loved ones. All life insurance policy strategies are created to assist fill financial voids that would open up if the main supplier died all of a sudden.

This would permit your family to proceed staying in the home you developed with each other. While all life insurance policies pay a death advantage to the beneficiary money that could be utilized to pay the home mortgage there are several other variables to think about when it comes to choosing the appropriate policy for your demands.

Depending on when you buy a term life policy, it can supply defense for the duration in your life when you have the most household expenses for your household. Many people select term life insurance policy to synchronize with the size of their mortgage benefit.

Take into consideration speaking to a monetary representative that might aid you run the numbers and determine on the right protection quantity for your needs. While entire life and global life insurance can be utilized to assist pay home loan costs, many individuals pick term life insurance policy instead because it is typically the most budget-friendly choice.

Video Transcript Hi! Costs Diehl below at Western & Southern Financial Group and today we're mosting likely to chat concerning a principle called home loan needs and exactly how a life insurance policy plan might contribute with your home loan. You heard that right: life insurance policy and home loans. What's the offer? Why would any individual placed life insurance policy and a home loan into the very same sentence? Well, life insurance policy can actually play a role in your home mortgage approach.

However what concerning you exactly how are your liked ones shielded? Below's where life insurance policy comes in: if a breadwinner were to die a life insurance coverage plan might potentially help loved ones stay in the family home. insurance on a mortgage. Life insurance policy pays an instant survivor benefit as quickly as proof of death of the insured person is equipped to the insurance company

Life Insurance To Cover Home Mortgage

And while these profits can be utilized for anything when it comes to a home loan protection technique, they're utilized to help maintain settling the home loan hence allowing the enduring family members to remain in their home. That's the bargain: life insurance policy and mortgages can exist together and if you're interested in finding out even more regarding just how life insurance policy might play a duty in your mortgage technique, talk to a financial specialist.

Hey, many thanks for viewing today! If you like this video, please make certain to tap such switch below and register for this channel. Home loan insurance policy is a sort of insurance policy that safeguards lenders in the event that a borrower defaults on their home mortgage repayments. The finance is developed to minimize the threat to the loan provider by giving compensation for any losses if the customer is unable to pay back.

Month-to-month home mortgage payments are boosted to consist of the cost of PMI.: MIP is a type of insurance policy needed for some lendings guaranteed by the federal government, like FHA (Federal Real estate Administration) lendings. house and life insurance. It safeguards the loan provider against losses in instance the consumer defaults on the lending. MIP might be paid in advance at the time of funding closing as a single fee or as part of the consumer's repeating monthly home loan repayments

It does not shield the consumer in case of default yet allows customers to get a mortgage with a lower deposit. Also if you have home loan insurance coverage with your financial institution or home mortgage financing, you can still require life insurance coverage. That's since financial institution home mortgage security only provides mortgage benefit, and the recipient of that policy is usually the bank that would receive the funds.

Mortgage Disability Insurance Coverage

It might aid pay prompt costs and supply mortgage security. It could also aid your loved ones pay back debts, cover education and learning expenses and more. You may even be able to change the financial institution home loan insurance plan with one acquired from a life insurance policy firm, which would let you choose your recipient.

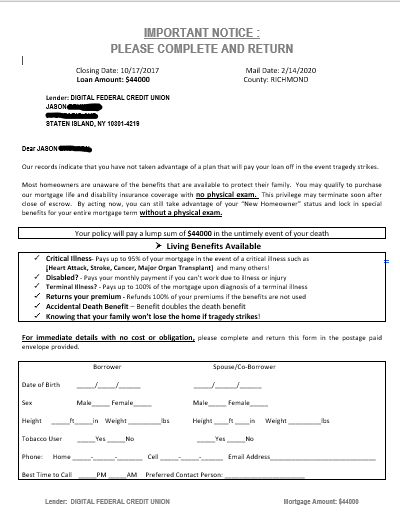

If a debtor were to die or shed the ability to hold back steady employment for example, as a result of an injury or medical problem MPI could cover the principal and rate of interest on the home funding. As a property owner with a home loan, you need to prepare for the future. Allow's take a hard consider what home loan security insurance has to offer so you can make a decision if it makes feeling to protect coverage for on your own and your family members.

As a matter of fact, property owners insurance is one of the most pricey real estate costs you'll pay every month. And depending on where you live, you may be needed to acquire additional threat insurance policy policies to cover dangers like flooding, hurricanes and earthquakes. Mortgage protection insurance policy is a totally various sort of insurance policy, however.

But MPI can help minimize those problems altogether. When you buy MPI, your policy could cover the size of your mortgage. So, if you have a 15-year set rate home mortgage, your MPI strategy might compete 15 years. MPI is in some cases also referred to as mortgage life insurance policy or perhaps home mortgage fatality insurance policy since it pays a benefit when the insurance policy holder dies, similar to common life insurance policy.

There may be exemptions that avoid beneficiaries from getting a payment if the policyholder were to die by suicide (in the first 2 years) instead than natural causes or crash. Suppose there are several borrowers on a home funding, though? Oftentimes, you can purchase home loan security to cover two perhaps more co-borrowers or cosigners on a mortgage.

As we kept in mind, home loan repayment security insurance can consist of special motorcyclists known as that cover persistent or important disease. They might likewise offer insurance coverage for severe injuries that avoid insurance policy holders from operating at complete ability. In these situations, consumers are still alive, but because of lessened revenues, are not able to make month-to-month home mortgage settlements completely.

Loan Insurance

Home loan defense insurance coverage can cover simply about any kind of real estate cost you want. Settle your whole home funding in one go? Put down simply the minimum monthly repayment on your home lending?

As soon as those funds hit your checking account, you can use them any type of way you such as. Spend that money on your month-to-month real estate prices, wait for a rainy day or cover various other expenditures like clinical expenses, vehicle settlements and tuition. Where MPI can absolutely set itself aside from term life insurance policy is with.

As an insurance policy holder, if you pick to accelerate your home loan defense insurance policy payment, you can do so in simply regarding any type of amount you like. Purchase an MPI plan with living benefit cyclists for vital and chronic health problem.

Do You Need Life Insurance To Buy A House

Offered exactly how beneficial they can be for households dealing with difficulty, though, it may be worth looking for an insurance professional who specializes in these sorts of policies. In the substantial bulk of situations, MPI advantages are paid to the policyholder's recipients. They can after that spend that money any kind of way they such as.

The selection is yours totally. That is, unless you take out a credit history life insurance policy policy. These insurance coverage intends give the survivor benefit straight to your lending institution, who would after that repay your home loan. The money would never touch your hands. Actually, however, credit rating life insurance policy is unbelievably uncommon, so you're not likely to come across it.

It's cost-free, basic and safe. Whether mortgage life insurance policy is the best policy for you depends mainly on your age and health. Youthful home owners with limited clinical problems will obtain much better quotes and greater insurance coverage options with term life insurance policy. On the other hand, if you have serious health issues and will not receive term life insurance policy, after that home mortgage life insurance policy can be an excellent choice, because it doesn't take your wellness into account when setting prices and will supply larger survivor benefit than numerous alternatives.

Some plans connect the survivor benefit to the impressive home loan principal. This will act similarly to a lowering death advantage, however if you repay your home mortgage faster or slower than expected, the policy will reflect that. The survivor benefit will stay the exact same over the life of the policy.

Relying on the provider, home loan life insurance policy. If the policy is connected to your home, you would certainly need to get a brand-new plan if you move. And due to the fact that life insurance policy quotes are linked to your age, this suggests the premium will certainly be greater. A home loan protection plan that's packed right into your home loan is a lot more limiting, as you can not select to cancel your protection if it comes to be unneeded.

Mortgage Protection Agents

You would have to continue paying for an unneeded benefit. Term and mortgage life insurance coverage plans have several similarities, but particularly if you're healthy and a nonsmoker.

If there are extra important expenses at the time of your death or your family determines not to maintain your home, they can utilize the full term-life insurance policy payment nonetheless they select. Home loan life insurance coverage quotes are more costly for healthy and balanced house owners, due to the fact that the majority of plans don't require you to obtain a medical examination.

Table of Contents

Latest Posts

Burial Insurance

Funeral And Burial Insurance

Pre Need Burial Insurance

More

Latest Posts

Burial Insurance

Funeral And Burial Insurance

Pre Need Burial Insurance