Featured

Table of Contents

Term life insurance policy is a type of policy that lasts a particular size of time, called the term. You pick the length of the plan term when you first take out your life insurance coverage.

Pick your term and your amount of cover. You may have to answer some questions about your medical history. Select the policy that's right for you. Currently, all you need to do is pay your premiums. As it's level term, you know your premiums will stay the same throughout the term of the policy.

How do I apply for Level Term Life Insurance Benefits?

(Nonetheless, you do not receive any cash back) 97% of term life insurance policy cases are paid by the insurance provider - SourceLife insurance policy covers most scenarios of fatality, but there will certainly be some exclusions in the terms of the policy. Exemptions may consist of: Hereditary or pre-existing conditions that you fell short to reveal at the start of the policyAlcohol or medicine abuseDeath while dedicating a crimeAccidents while taking part in harmful sportsSuicide (some policies leave out death by self-destruction for the initial year of the plan) You can include critical disease cover to your degree term life insurance coverage for an extra cost.Critical health problem cover pays a part of your cover quantity if you are identified with a significant disease such as cancer cells, heart attack or stroke.

After this, the plan ends and the surviving partner is no longer covered. Joint policies are normally extra affordable than single life insurance coverage plans.

This safeguards the buying power of your cover quantity versus inflationLife cover is a great point to have because it gives monetary security for your dependents if the worst takes place and you die. Your liked ones can additionally utilize your life insurance policy payment to pay for your funeral service. Whatever they select to do, it's great peace of mind for you.

Degree term cover is excellent for fulfilling daily living costs such as household costs. You can additionally utilize your life insurance policy benefit to cover your interest-only mortgage, repayment mortgage, college fees or any other financial debts or recurring settlements. On the various other hand, there are some drawbacks to degree cover, compared to other types of life policy.

How do I choose the right What Is Level Term Life Insurance??

Words "level" in the phrase "level term insurance" indicates that this sort of insurance has a fixed premium and face amount (survivor benefit) throughout the life of the policy. Put simply, when people speak about term life insurance policy, they commonly describe degree term life insurance policy. For most of individuals, it is the simplest and most cost effective choice of all life insurance kinds.

The word "term" here describes a given variety of years during which the level term life insurance policy stays energetic. Degree term life insurance policy is one of one of the most popular life insurance policy plans that life insurance policy companies provide to their customers because of its simplicity and price. It is additionally easy to compare level term life insurance policy quotes and obtain the finest premiums.

The system is as adheres to: To start with, pick a plan, survivor benefit quantity and policy duration (or term length). Second of all, choose to pay on either a month-to-month or yearly basis. If your premature demise occurs within the life of the policy, your life insurer will pay a swelling sum of fatality benefit to your established recipients.

Level Term Life Insurance For Families

Your level term life insurance policy expires once you come to the end of your plan's term. At this factor, you have the adhering to options: Option A: Remain without insurance. This choice suits you when you can insure on your very own and when you have no debts or dependents. Alternative B: Get a brand-new degree term life insurance policy.

Your present browser could restrict that experience. You might be making use of an old internet browser that's in need of support, or settings within your browser that are not compatible with our website.

Why do I need Tax Benefits Of Level Term Life Insurance?

Currently using an upgraded browser and still having trouble? Your present web browser: Detecting ...

If the policy expires before runs out death or you live beyond the policy termPlan there is no payout. You may be able to restore a term plan at expiration, however the costs will certainly be recalculated based on your age at the time of renewal.

As you can see, the very same 30-year-old healthy and balanced man would certainly pay an average of $282 a month. At 50, he 'd pay $571. Whole Life Insurance Coverage Fees 30 $282 $247 40 $382 $352 50 $571 $498 60 $887 $782 Resource: Quotacy. Quotes are for a $500,000 long-term life insurance policy policy, for guys and ladies in superb wellness.

Why should I have Tax Benefits Of Level Term Life Insurance?

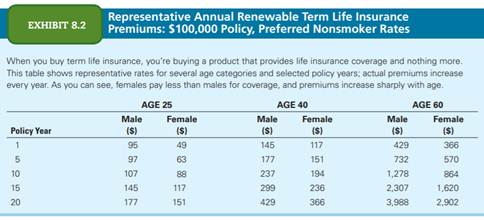

That lowers the overall risk to the insurer contrasted to a long-term life plan. The minimized risk is one aspect that enables insurance firms to charge reduced costs. Rate of interest, the financials of the insurance company, and state regulations can also impact premiums. In general, companies usually offer better prices at the "breakpoint" protection levels of $100,000, $250,000, $500,000, and $1,000,000.

Inspect our recommendations for the best term life insurance policy policies when you are ready to acquire. Thirty-year-old George wishes to safeguard his household in the not likely occasion of his early fatality. He acquires a 10-year, $500,000 term life insurance policy with a premium of $50 monthly. If George passes away within the 10-year term, the plan will certainly pay George's recipient $500,000.

If he continues to be to life and renews the policy after 10 years, the costs will certainly be higher than his first policy due to the fact that they will certainly be based on his existing age of 40 instead of 30. Guaranteed level term life insurance. If George is identified with an incurable illness throughout the initial policy term, he most likely will not be qualified to restore the policy when it expires

There are numerous kinds of term life insurance policy. The best choice will certainly depend on your individual conditions. Generally, most companies supply terms varying from 10 to three decades, although a couple of deal 35- and 40-year terms. Level-premium insurance policy has a set month-to-month repayment for the life of the policy. A lot of term life insurance policy has a degree premium, and it's the type we've been describing in a lot of this article.

How does Level Term Life Insurance Policy work?

They might be an excellent choice for a person that needs temporary insurance policy. The insurance policy holder pays a taken care of, level premium for the period of the policy.

Table of Contents

Latest Posts

Burial Insurance

Funeral And Burial Insurance

Pre Need Burial Insurance

More

Latest Posts

Burial Insurance

Funeral And Burial Insurance

Pre Need Burial Insurance