Featured

Table of Contents

Here's just how the 2 contrast. The vital distinction: MPI insurance coverage pays off the staying equilibrium on your home loan, whereas life insurance policy provides your recipients a death advantage that can be utilized for any type of objective (mortgage protection insurance premium).

Many policies have a maximum limitation on the dimension of the home loan balance that can be insured. This maximum quantity will certainly be explained when you obtain your Mortgage Life Insurance coverage, and will certainly be recorded in your certification of insurance coverage. However also if your starting home mortgage equilibrium is greater than the maximum limitation, you can still guarantee it approximately that limitation.

They also such as the truth that the earnings of her home loan life insurance coverage will go directly to pay the home loan equilibrium instead of possibly being used to pay other financial debts. mortgage insurance for job loss. It is very important to Anne-Sophie that her family members will have the ability to proceed residing in their household home, without economic discomfort

However, maintaining all of these acronyms and insurance types directly can be a migraine. The adhering to table positions them side-by-side so you can rapidly set apart among them if you obtain perplexed. Another insurance policy coverage kind that can settle your home loan if you die is a conventional life insurance policy plan.

Critical Illness Insurance Mortgage

A remains in location for an established number of years, such as 10, 20 or thirty years, and pays your beneficiaries if you were to pass away during that term. An offers insurance coverage for your whole lifetime and pays when you pass away. Rather of paying your home loan loan provider straight the means mortgage protection insurance does, common life insurance policy plans go to the recipients you select, that can then pick to settle the home mortgage.

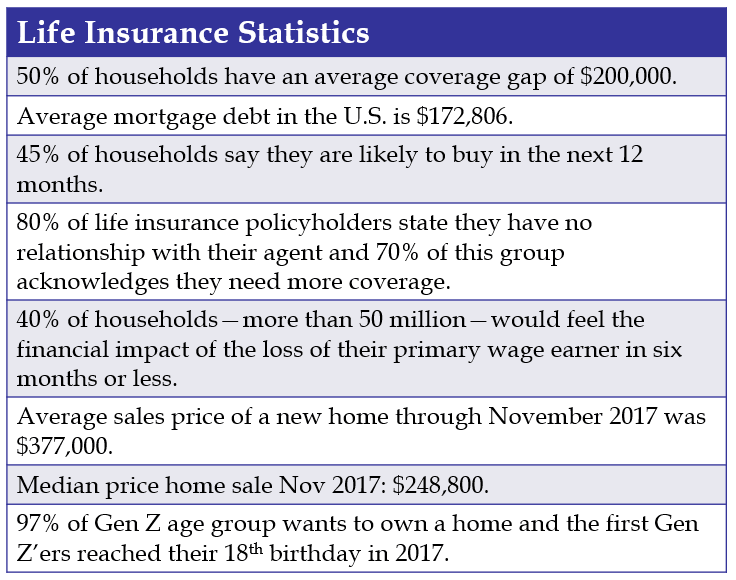

One typical regulation of thumb is to go for a life insurance policy policy that will pay approximately 10 times the insurance holder's salary amount. You might pick to make use of something like the Cent technique, which adds a household's financial debt, income, home loan and education costs to determine just how much life insurance policy is needed.

It's also worth keeping in mind that there are age-related limits and thresholds enforced by virtually all insurance companies, that typically will not provide older purchasers as several choices, will certainly charge them a lot more or may reject them outright. iprotect mortgage insurance.

What Insurance Is Needed For A Mortgage

Right here's how home mortgage security insurance gauges up versus standard life insurance policy. If you're able to qualify for term life insurance policy, you must stay clear of home loan defense insurance policy (MPI).

In those situations, MPI can provide fantastic peace of mind. Every home mortgage security choice will have many rules, regulations, advantage choices and downsides that require to be considered carefully against your precise circumstance.

A life insurance coverage policy can aid pay off your home's mortgage if you were to die. It's one of lots of means that life insurance may help protect your enjoyed ones and their monetary future. Among the very best methods to factor your mortgage into your life insurance policy demand is to speak with your insurance coverage agent.

Rather of a one-size-fits-all life insurance coverage policy, American Domesticity Insurer provides plans that can be developed particularly to fulfill your family members's requirements. Right here are several of your options: A term life insurance plan (decreasing term mortgage insurance) is energetic for a certain amount of time and normally supplies a bigger amount of protection at a reduced cost than a permanent plan

A whole life insurance coverage plan is just what it seems like. Rather than only covering an established number of years, it can cover you for your whole life. It likewise has living benefits, such as cash worth build-up. * American Family Life Insurer provides various life insurance policy plans. Speak with your representative regarding tailoring a policy or a combination of plans today and obtaining the satisfaction you deserve.

Your representative is a fantastic source to answer your questions. They may also have the ability to assist you find spaces in your life insurance policy protection or new methods to save on your various other insurance coverage. ***Yes. A life insurance policy recipient can select to make use of the death benefit for anything. It's a terrific method to assist safeguard the economic future of your family members if you were to pass away.

Home Loan Property Insurance

Life insurance policy is one way of assisting your family in paying off a mortgage if you were to pass away before the home mortgage is completely repaid. No. Life insurance policy is not obligatory, however it can be a vital part helpful see to it your enjoyed ones are economically protected. Life insurance policy earnings may be used to aid settle a home loan, however it is not the like mortgage insurance that you may be required to have as a problem of a funding.

Life insurance coverage might aid guarantee your home remains in your family by offering a fatality advantage that might assist pay down a home loan or make crucial acquisitions if you were to pass away. This is a quick description of coverage and is subject to policy and/or motorcyclist terms and problems, which might differ by state - why do i pay mortgage insurance.

Credit Life Insurance For Mortgage

The words lifetime, lifelong and irreversible undergo policy terms. * Any loans taken from your life insurance policy plan will certainly accumulate interest. Any type of superior financing equilibrium (financing plus passion) will be deducted from the survivor benefit at the time of case or from the money value at the time of abandonment.

Discount rates do not apply to the life policy. Plan Kinds: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22 - how does mortgage life insurance work.

Mortgage security insurance policy (MPI) is a various kind of safeguard that could be practical if you're not able to settle your home loan. Home mortgage protection insurance is an insurance policy that pays off the remainder of your home mortgage if you pass away or if you come to be handicapped and can't work.

Like PMI, MIP safeguards the loan provider, not you. Unlike PMI, you'll pay MIP for the duration of the funding term. Both PMI and MIP are called for insurance coverage protections. An MPI plan is completely optional. The quantity you'll spend for home mortgage protection insurance depends on a range of factors, consisting of the insurance company and the present equilibrium of your home mortgage.

Still, there are advantages and disadvantages: The majority of MPI policies are issued on a "guaranteed approval" basis. That can be useful if you have a health and wellness problem and pay high rates for life insurance or battle to obtain insurance coverage. An MPI plan can provide you and your household with a feeling of protection.

Home Mortgage Life Insurance Rates

It can also be handy for people that do not receive or can't afford a conventional life insurance policy plan. You can choose whether you require mortgage protection insurance coverage and for just how long you require it. The terms typically range from 10 to thirty years. You might want your home loan protection insurance coverage term to be enclose length to how much time you have actually entrusted to pay off your mortgage You can terminate a home loan protection insurance plan.

Table of Contents

Latest Posts

Life Insurance To Cover Mortgage Payments

How do I choose the right Level Term Life Insurance For Young Adults?

What Is 30-year Level Term Life Insurance? A Complete Guide

More

Latest Posts

Life Insurance To Cover Mortgage Payments

How do I choose the right Level Term Life Insurance For Young Adults?

What Is 30-year Level Term Life Insurance? A Complete Guide